'Incredible and Gross Negligence': Pa. Federal Judge Sanctions Ikea for Destroying Evidence

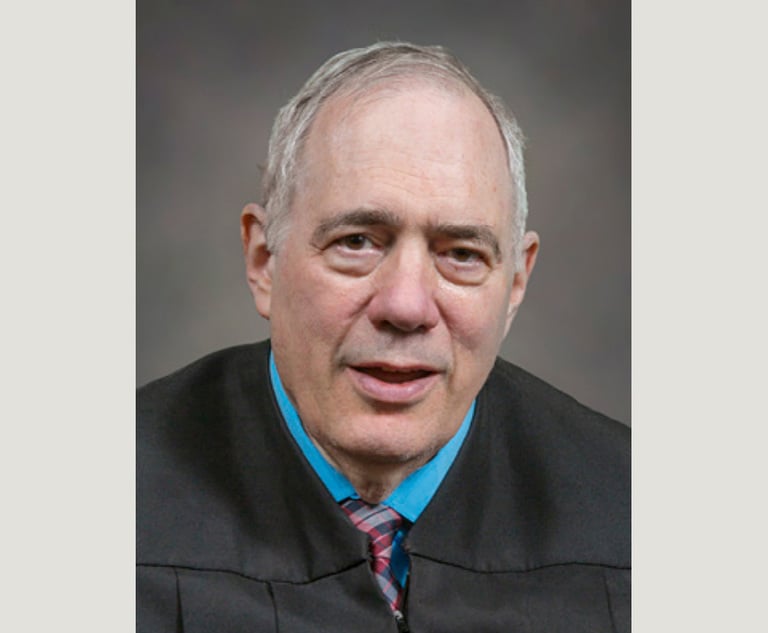

Brody ruled that Ikea’s deletion of four email accounts significantly prejudiced the plaintiffs, and the company’s “conduct and strategy of delay and obfuscation since plaintiffs first inquired about the deleted accounts in January 2023 displayed a lack of candor that is offensive to a court.”

3 minute read